To drive change in Edmonton, it’s essential for our business community to understand the city’s budget process, how it impacts local businesses, and where the Edmonton Chamber of Commerce is making a difference.

Fast Facts

- The City of Edmonton uses a multi-year planning process to set the municipal budget.

- At the beginning of the budget cycle, City Council approves a four-year capital and operating budgets that support municipal service delivery.

- Twice a year, City Administration recommends adjustments to the four-year capital and operating budgets to reflect changes in priorities or revenue and expense projections.

- City Council approved the city’s most recent 2023-2026 capital and operating budgets on December 22, 2022.

- Several adjustments have been made to the budget since its approval. City Council will make the next round of adjustments at the December 2, 2024, City Council meeting.

- The City of Edmonton’s operating budget was $3.48B in 2024.

- The City of Edmonton's capital budget was $10.8B for 2023-26.

- Annual tax increases of 4.96% in 2023, 4.96% in 2024, 4.95% in 2026 and 4.39% in 2026 were approved at the start of the budget cycle to implement the budget.

- City Council has adjusted the annual tax increases to offset costs related to population growth, high inflation, changing consumer preferences, and unplanned cost increases.

- The most recent estimates suggest that annual tax will be increased by 3.9%, 3.9%, and 3.9% in 2023, 2024, 2025, and 2026 (respectively).

Member Perspectives

The Edmonton Chamber of Commerce surveyed its members from September 16 - October 3, 2024 about their municipal budget perspectives and priorities. Here's what our members are saying:

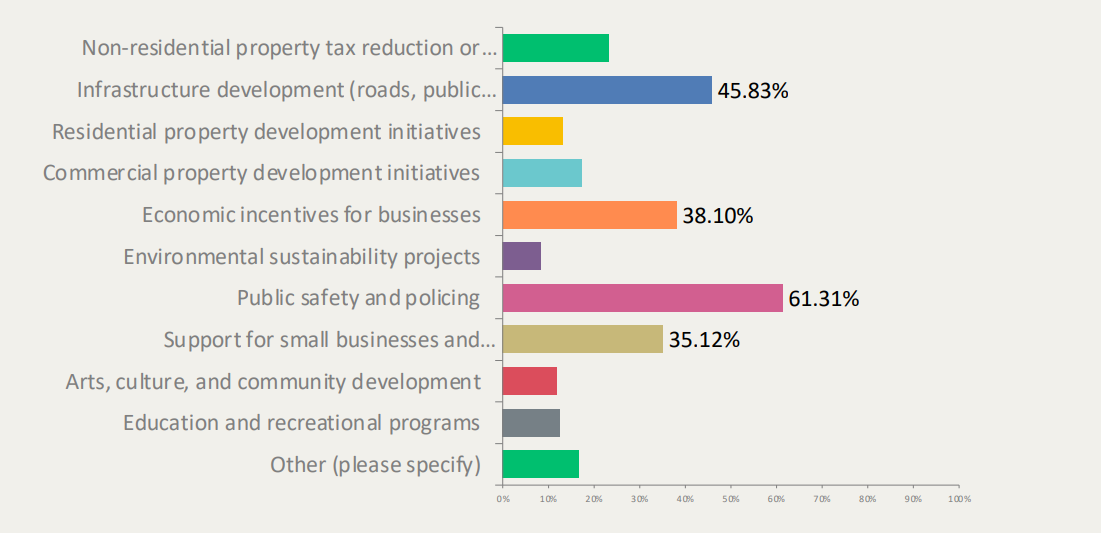

Our Members' Top Priorities

The Chamber's Perspective

The Edmonton Chamber of Commerce - alongside BOMA Edmonton, BILD Edmonton, and NAIOP Edmonton - remain concerned about ongoing increases to municipal property taxes, which are projected to increase by 8.1% in 2025 and 6.3% in 2026. Edmonton is in a fiscal crisis and appropriate, collaborative action must be taken in the short and long-term.

In our letter to City Council, we expressed these concerns and suggested practical solutions:

Key Concerns:

- Soaring Property Taxes: We expressed deep concern over the projected 8.1% increase in property taxes in 2025, followed by a 6.3% increase in 2026.

- Fiscal Crisis: The city's financial situation is described as a "fiscal crisis" requiring immediate and collaborative solutions.

- Non-Core Services: We urged the city to focus on core municipal services and consider divesting from non-core services that could be better handled by the private sector or other levels of government.

- Cost Recovery: The city is encouraged to improve cost recovery for services like public transit and recreation centers.

- Investment Priorities: We emphasized the need to invest in areas with high returns, such as downtown revitalization and infrastructure development.

- Competitive Tax Environment: The city should strive to create a more competitive tax environment to attract businesses and investment.

- Efficiency and Accountability: We called for greater efficiency and accountability in city operations, including a review of staffing levels and procurement practices.

Proposed Solutions:

- Fiscal Task Force: The coalition recommends the formation of a task force to assess the city's financial health and develop a long-term financial plan.

- Redefining Edmonton's Vision: The city should revisit its vision and set more ambitious goals to position Edmonton as a global city.

- Global Competitiveness Project: A project should be launched to learn from other successful global cities and implement best practices.

The business community is committed to working with the city to address these challenges and ensure a prosperous future for Edmonton.