As a former politician, I know all too well government budgets are as much about political calculations as they are about financial ones. The 2024 federal budget was no exception.

The Liberal government is under immense political pressure to deal with a multitude of issues including alleviating the nation-wide housing crisis while helping Canadians deal with the cost of living. This will take money, billions of dollars' worth of investments. That's where we run into problems.

From my own, once-upon-a-time experience as a cabinet minister with the Alberta government, I acknowledge the complexities and difficulties of balancing fiscal responsibility with strategic investments. But as President of the Edmonton Chamber, I must call to everyone’s attention our concerns with changes to the tax regime, specifically the increased inclusion rate on capital gains tax for corporations.

The 2024 Federal budget has a few gems in it. From a comprehensive housing plan, the updates to the Canadian Entrepreneurs’ Incentive and the new Canada Carbon Rebate for Small Businesses, the Edmonton Chamber of Commerce applauds measures that aim to improve the affordability of businesses. We’re hopeful the budget’s investments will help businesses thrive by cutting red tape, facilitating access to talent, and encouraging innovation and productivity.

Because the government has announced $50 billion in new spending, it needs a way to collect more revenue to pay for it all. Finance Minister Chrystia Freeland concluded one of the best courses of action was through capital gains. Those are the profits earned by individuals and corporations when they cash in things such as real estate, stocks or selling a business. Freeland argues her policy would only impact the richest of the rich.

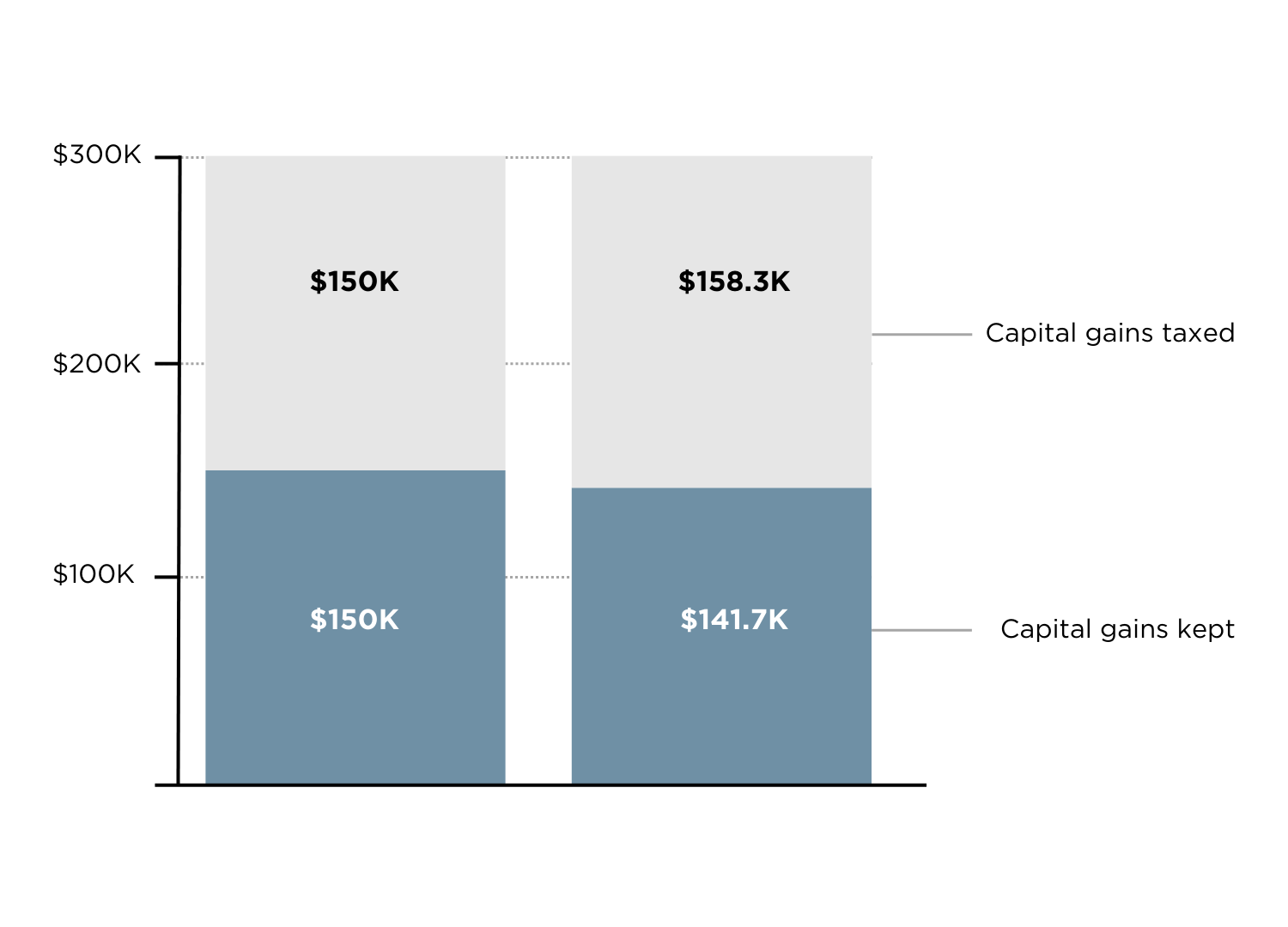

An example of how changes will affect capital gains

In this example written by the government, this Ontario resident has a $400,000 salary with capital gains of $300,000. This is how tax changes will affect capital gains.

The government aims to increase the taxable portion of capital gains above $250,000 from 50 percent to 66.7 percent. That’s where we at the Edmonton Chamber see a problem. Many others should, too, even if they aren’t selling a stock portfolio, a business or a second residence.

The government is trying to make it sound like the tax change will only affect a tiny number of Canadians, some 40,000 of the wealthiest. But the change also threatens to impact 307,000 companies across the country, about one-in-four businesses. In Edmonton that equates to 38,000 businesses. The change is so minuscule, it doesn’t even begin to cover the federal spending in this budget. The idea that Prime Minister Justin Trudeau continues to reiterate that “we are asking the most successful in this country to do a little bit more to make sure that everyone can see themselves in the success of this country”, doesn’t really add up for me.

The government is casting a net aimed at what it hopes many people will picture as Milburn Pennybags, the portly old Monopoly mascot with moustache and top hat running a string of hotels on Boardwalk. But the net will not just catch the ultra-rich, but potentially a wide swath of others from accountants to auto mechanics, every professional in Canada who runs a corporation, even if that corporation is a small business.

Canadian Medical Association president Kathleen Ross told the Canadian Press that many doctors dislike the tax hike because they incorporate their medical practices and invest for their retirement within their corporations. While that is true, we also must understand that for many small and medium business owners, their entire savings depend on their largest asset – their business.

I, of course, am not the only one raising the alarm. Many others have pointed out that the changes to the capital gains tax regime will hinder the innovation economy, discourage risk-taking and hobble the very type of investment we need to boost productivity.

According to Carolyn Rogers, senior deputy governor of the Bank of Canada, the country’s rate of productivity has declined to the point of being an “emergency.” “An economy with low productivity can grow only so quickly before inflation sets in,” said Rogers in a speech a few weeks ago. “But an economy with strong productivity can have faster growth, more jobs and higher wages with less risk of inflation.”

The federal budget gets a number of things right. But when it comes to the inclusion rate on capital gains tax for corporations, it has got one important thing very wrong.

Have your say.

The Edmonton Chamber wants to hear from you. What are the top issues and priorities for your business this spring? Start the conversation by writing to policy@edmontonchamber.com